Our Mission

Manhattan Hospitality Advisors (MHA) is a hospitality advisory firm in its third decade of creating and protecting asset value. We have maximized investment returns for our worldwide clients, lending institutions, and developers of over $17 billion of hotels, resorts, spas, conference centers, and mixed-use projects.

We have asset managed individual and portfolio hotel and resort assets in 26 states and over a dozen countries from select service to luxury.

We offer strategic planning and repositioning management expertise to lenders and special servicers.

MHA has asset managed individual and portfolio hotel assets of over $9 billion dollars, at every price point, with particular expertise in boutique, full service, luxury hotels, and resorts.

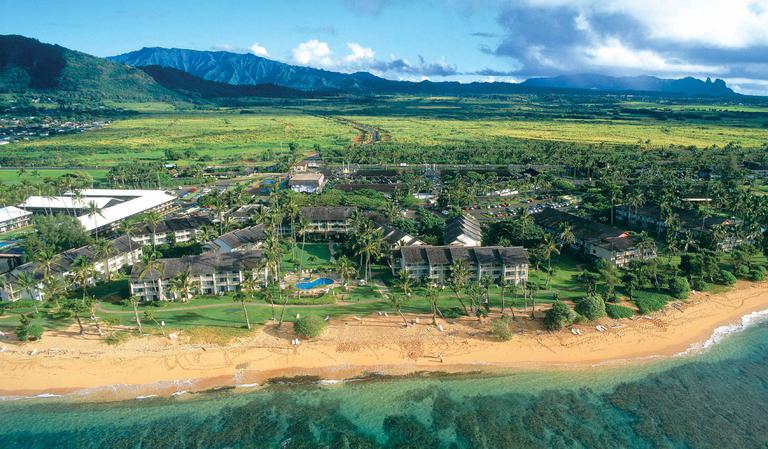

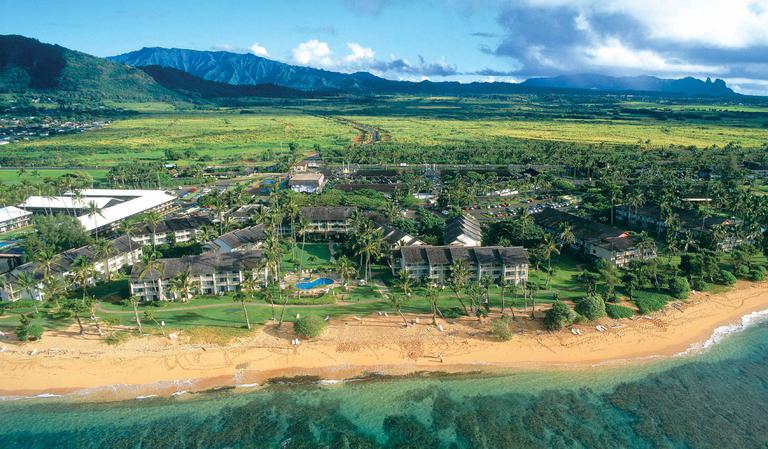

MHA has played an integral part in the development of over $8 billion dollars of new hotel, resort, spa, and mixed-use projects around the world, including projects throughout the continental United States, Europe, Hawaii, Mexico, Fiji, Costa Rica, Puerto Rico, and the Cayman Islands.

• Acquisition Due Diligence

• Property Positioning and Repositioning

• Marketing/Operational Analysis

• Operator Assessment and Oversight

• Litigation Support

• Budget and Monthly P&L Analysis and Reporting

• Capital Expense Management

• New Product Development

• Best Use Analysis

• Business Plan Development

• Cost Containment and Revenue Enhancement Strategies

• Insurance Review and Assessment

• Franchise and Management RFP

• Technical Assistance

• Programming and Space Planning

• Construction Team Member RFP’s and Contract Negotiations

• Plan Review

• Concept Development

• Cost Analysis and Budgeting

• Layout and Design Review

• Brand Analysis and Negotiations

• Value Engineering

• Vision Book Creation

• Schedule and Budget Development

• FF&E and OS&E Reporting and Tracking

• Distressed asset triage team consisting of advisory services, legal, and operational experts

• Analysis of ownership, franchise, operator, and loan documents

• Past and current performance compared to market and comp set

• Evaluate current operator and franchise - keep, change, push for better terms

• Creation of specific asset recovery plan

• Financial modeling, proforma and projections

• Financial restructuring and work outs

• Rescue capital, debt acquisition, and asset acquisition

• Cap-ex and PIP evaluation and oversight

• Receivership

• Cash flow management and oversight

• Pre-take over Comprehensive Planning

• Experience Structuring Receivership Order for Optimal Results

• Securing Estate Assets and Cash

• Management of Capital Expenditures and Resolution of Fire Life Safety Issues

• Cost Containment and Creative Revenue Enhancement Strategies

• Asset Management with Third Party Operator Asset Managed Over $3 Billion Worth of Hospitality Assets

• Management With Over 35 Years of Hotel Operations Experience

• Court, Owner, and Lender Reporting

• Over 35 Years of Experience in Hotel Management

• Initial Analysis of Property Positioning and All Product and Service Offerings

• Business Planning to Reposition and Enhance the Value of the Asset

MHA has never failed to find revenue enhancement, cost reductions and value enhancement for any asset on which we have been engaged.

We can provide expert assessments and due diligence in a quick manner, providing an expert opinion on the true health of the asset.

We have a proprietary program called “SAVE” that stands for Strategic Asset Value Enhancement, and allows us to provide lenders either a deep dive or executive summary of an asset, thus saving them time in order to quickly evaluate an asset’s potential and develop appropriate strategies in multiple markets with significant, measurable financial success.

We have successfully negotiated over 200 franchise and management agreements with most major hard and soft brands.

Through our global hospitality network, we can connect you to top professionals that have worked on over $87 billion of hospitality assets and negotiated over 1,000 management and franchise agreements.

Our team has access to hundreds of millions of dollars of rescue capital, debt acquisition capital, and asset acquisition capital.